The April 26 share sale deadline is linked to BBBY's obligation to submit the 10-K to the SEC. BBBY is facing a race against time to raise $300 million from equity markets by April 26 to avoid bankruptcy. On March 30, 2023, BBBY launched an "at-the-market" offering program to sell up to $300 million of shares. This unwillingness suggests that creditors are unlikely to take on the additional financial risk associated with BBBY, further increasing the likelihood of a bankruptcy outcome in 2023. BBBY's inability to complete its debt exchange offering indicates that lenders are unwilling to swap their positions on the balance sheet due to BBBY's unstable cash flow generation. Bankruptcy Looming on the HorizonīBBY's financial situation is so precarious that bankruptcy appears increasingly likely. The attempts to reorganize and rejuvenate the business have not been adequate, resulting in ongoing decreases in revenue and operational deficits. The subpar financial outcomes stem from various elements, including the failure to attract attention to their products, evolving customer tastes, and the organization's difficulty in adjusting to the swiftly transforming retail environment. For instance, on March 24, 2023, BBBY announced plans to lay off over 1,000 employees across various locations in New Jersey. With cash flow from operations at approximately $(307.6) million and liquidity of approximately $500 million, BBBY is on track to close 150 stores by the end of fiscal 2022 while initiating further cost reduction measures across corporate and supply chain segments.

BBBY's aggressive cost reduction initiatives led to a decrease in SG&A expenses however, a net loss for the quarter included $100.7 million of non-cash impairment charges.

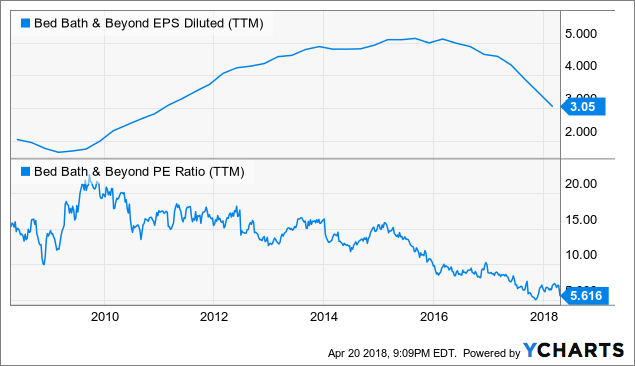

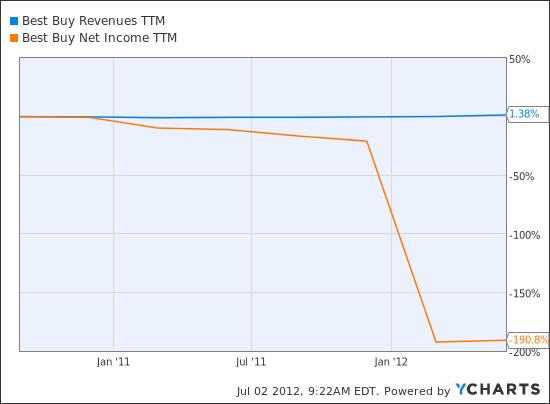

Despite an increase in Welcome Rewards memberships, BBBY's adjusted gross margin stood at a meager 22.8%, reflecting increased clearance activity and promotional activities. Both the BBBY banner and buybuy BABY experienced significant declines in comparable sales, mainly due to lower in-stock positions and decreased customer traffic. BBBY reported a net sales decline of 33%, driven by a comparable sales decrease of 32%. The third quarter results continued to deteriorate. Deteriorating Financials and Sales PerformanceīBBY's financial health has been deteriorating over the past few years, with increasing losses and dwindling liquidity. Despite its efforts to restructure and adapt, the company has been unable to recover, and its prospects look increasingly bleak, making shorting BBBY stock a compelling proposition. In this article, we will discuss the retailer's poor financial results, the looming threat of bankruptcy, and the long-term issues that plague BBBY. I don’t think BBBY will be able to raise $300 million from equity markets by April 26 to avoid bankruptcy. Bed Bath & Beyond ( BBBY)'s financial health and sales performance have been deteriorating, with increased competition, shifting consumer preferences, and leadership instability exacerbating BBBY's struggles.

0 kommentar(er)

0 kommentar(er)